Childcare Subsidy Information (CCS)

Changes to Child Care Subsidy

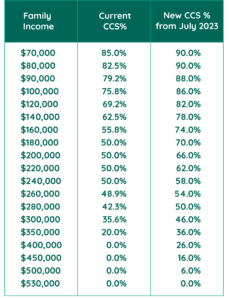

From July 2023 the Australian Government will be increasing its Child Care Subsidy (CCS) rates for families.

Some of the key changes that make this such positive news for Only About Children families include:

· Lifting the maximum CCS rate to 90% for families earning $80,000 or less

· Increasing CCS rates for around 96% of families with a child in care earning under $530,000

· Investing $33.7 million to increase subsidised ECEC to a minimum of 36 hours per fortnight for families with First Nations children

These changes are in addition to the increased Higher Sibling Subsidy the government introduced in early 2022.

CCS Rates & Savings Per Income Band

**Please note, this table is a guide only and changes to centre fees, the law, policy or your individual circumstances may mean that any Child Care Subsidy you are entitled to differs from the amount shown.

How To Calculate Childcare Subsidy

Child Subsidy Calculator

You can use this calculator to estimate your Childcare Subsidy entitlements

-

1

Your combined family income

-

2

The activity level of your family

Recognised activities that enable a family to claim

(eg paid work, volunteering, studying, self-employed work, actively job seeking) -

3

The type of childcare your child or children are enrolled in

For Only About Children, this is Long Day Care services

What is Childcare Subsidy (CCS)?

As a recognised childcare provider, we are registered for the Government Childcare Subsidy (CCS).

Only About Children is here to support you as you begin to discover your family’s CCS entitlements and the varied enrolment options available. We can help guide you to make the most of your CCS, so your child or children can benefit from the exciting opportunities that the right early learning or preschool/kindergarten environment can offer.

How does the Child Care Subsidy work?

The Child Care Subsidy will be paid directly to providers to be passed on to families as a fee reduction. Families will make a co-contribution to their child care fees and pay to the provider the difference between the fee charged and the subsidised amount.

Child Care Subsidy FAQs

Am I able to claim Government Child Care Subsidy if I enrol with Only About Children?

Yes, we are a registered childcare provider which means that eligible families are able to claim the Government Child Care Subsidy relating to your childcare.

The Child Care Subsidy (CCS) is designed to help make early learning and childcare more accessible for a large number of Australian families. Child Care Subsidy will generally be paid directly to your approved childcare provider/s to reduce the fees you pay.

Only About Children is here to support you as you begin to discover your family’s entitlements and the varied options available. We can help guide you to make the most of your CCS, so your child or children can benefit from the exciting opportunities that the right early learning or preschool/kindergarten environment can offer.

How does Child Care Subsidy work?

The Child Care Subsidy will be paid directly to providers to be passed on to families as a fee reduction. Families will make a co-contribution to their childcare fees and pay to the provider the difference between the fee charged and the subsidised amount.

How do I know if I am eligible for Child Care Subsidy?

There are certain requirements that must be satisfied for an individual to be eligible to receive the Child Care Subsidy (CCS) for their child. These include:

- The age of the child (must be 13 or under and not attending secondary school)

- The individual, or their partner, meeting the residency requirements

- The combined family income meeting the specified requirements

- The child meeting immunisation requirements

- The activity level of your family – See the Department of Education’s Child Care Subsidy Activity Test

To find out more information about CCS and eligibility please visit:

- The Department of Education has provided extensive Frequently Asked Questions on their website.

- For in-depth details on the Child Care Subsidy visit their website or contact the Department directly on 1300 566 046

How to Claim Childcare Subsidy

Your best online source of information for this is the Services Australia website page: How to Claim.

Checking entitlements through MyGov

To learn more about claiming the CCS, you can log into your MyGov account and complete an assessment task.

You’ll need your registered CRN to do this.

Related reads

Relaxing with Birdie: Stress Management Strategies for Children Through Transitions

Empower children through transitions with 'Relaxing with Birdie,' a trusted resource offering calming strategies and resilience-building techniques during periods of change.

Language First, Then Literacy

When preparing children for school, it's common to focus on literacy skills like reading and writing. However, there are other crucial skills essential for success in the classroom. This article highlights the importance of developing language understanding, clear speech, and social communication skills before diving into literacy and the age-specific milestones for these vital skills.